Functionality:

- Storage of HR policy and procedures

- Job descriptions

- Employee profiles

- Employment contracts

- Employee reviews

- Safety statements

- Accident logs

- Job costing

- Expenses

- Government forms /ROS

- Benefits /PRSA /Government Pensions

- Customised reporting and analysis

- Pay-path links and functionality

- Multi company

- User based security

- Accounts system integration

- Payroll history analysis

- Integrated Time Tracking

- Integrated Attendance Management

- Automates Net to Gross calculations

- Pay increase calculations

- SMS employees

- Employee Correspondence Management

- Email encrypted payslips

- Restrict user access levels

- Supports Weekly, Monthly & 4 weekly pay periods

- Undo and edit previous weeks calculations without having to renter timesheet details

- EHECS and NES form which can be uploaded directly to CSO

|

|

|

Payroll

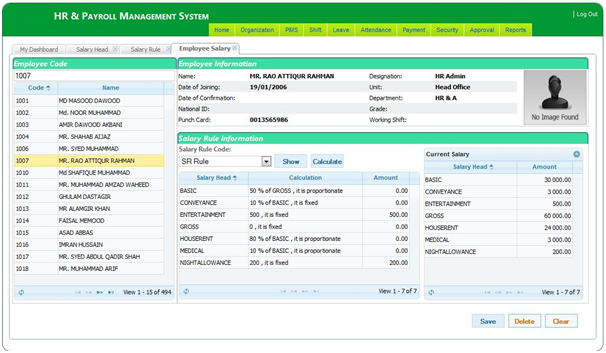

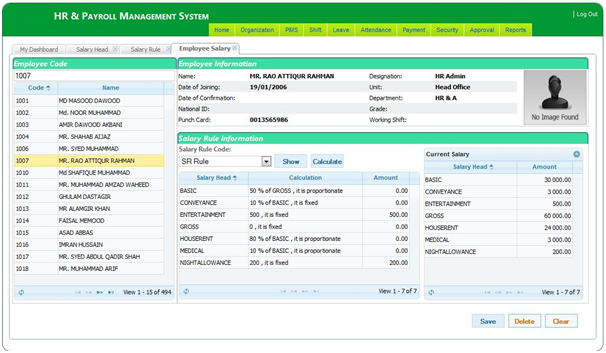

Entering payroll data is extremely quick and easy. Company and employee information is input and the default tax set up and rates are used to allow instant payroll processing. Wages and salaries, taxes, deductions and benefits are automatically computed for each person. Employees’ job sheets can be imported into timesheets and processed through the payroll system to calculate all payments due.

| Quick Timesheet Entry |

quick and easily enter or import the timesheets, whether hourly, gross to net, or net to gross. |

| Calculate Payroll |

one click calculates everyone’s payroll, simply click “undo” if you need to change a calculation. |

| Routine Listings |

print all your routine reports or simply batch report your pay slips, summary reports (adjustment summary, payment summary, audit trail, nominal ledger reports, P30 etc.) |